Cheapest auto insurance Indiana is a critical consideration for drivers in the state. Finding the most affordable rates while maintaining adequate coverage is a challenge many face. This guide explores strategies and insights to navigate the complexities of the Indiana insurance market, ultimately helping you find the best possible deal.

Factors like driving record, vehicle type, and location significantly influence premiums. Understanding these variables is key to securing the best possible rates. This article will Artikel some essential steps in the search for cheap auto insurance in Indiana.

Finding affordable auto insurance in Indiana, like many states, can feel like a maze. This guide will break down the key factors, offer tips, and point you toward resources to help you navigate the process and secure the best possible deal.

Understanding Indiana Auto Insurance Requirements

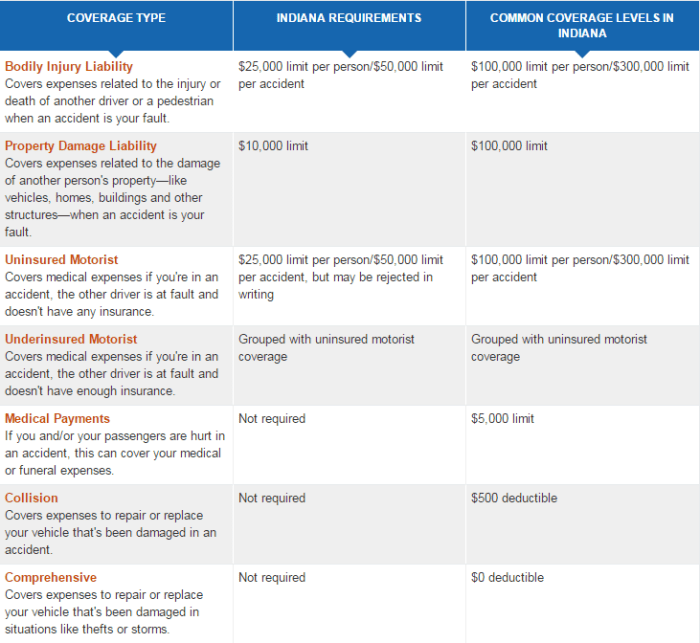

Indiana, like other states, mandates minimum liability coverage. However, this minimum often isn’t enough to protect you financially in the event of an accident. Understanding the specific requirements is crucial for your peace of mind. You should strongly consider exceeding the minimum coverage. This often means looking at options like comprehensive and collision coverage, which are essential in protecting your vehicle and financial well-being.

Comprehensive coverage will protect you against damages not caused by a collision, such as weather damage or vandalism. Collision coverage covers damage caused by a collision with another vehicle or object.

Source: wikitechy.com

Minimum Requirements and Recommended Coverage Levels

- Bodily Injury Liability (BIL): Indiana’s minimum is often considered insufficient, especially for those with high-value assets. Consider higher limits for a stronger safety net.

- Property Damage Liability (PDL): Similar to BIL, the minimum may not fully protect you from potential damages. Increasing your PDL limits is a good idea.

- Uninsured/Underinsured Motorist (UM/UIM): This is absolutely crucial. It protects you if you’re involved in an accident with someone who doesn’t have insurance or has insufficient coverage.

- Collision and Comprehensive Coverage: These coverages are optional but highly recommended. Collision covers damage to your vehicle in an accident, while comprehensive covers damage from other events (e.g., theft, vandalism).

Factors Influencing Auto Insurance Costs in Indiana

Several factors influence the cost of your auto insurance premium in Indiana. Understanding these factors allows you to make informed decisions and potentially lower your premiums.

Driving Record and History

Your driving record is a major factor. Accidents, traffic violations, and speeding tickets significantly increase your insurance rates. Maintaining a clean driving record is key to getting the cheapest auto insurance.

Vehicle Type and Value

The type and value of your vehicle play a role. High-performance sports cars, luxury vehicles, and newer models tend to have higher insurance premiums than more basic or older vehicles.

Location and Area

Your location within Indiana can impact insurance rates. Areas with higher crime rates or accident-prone roads may have higher premiums. Consider the specific area where you reside.

Age and Gender

Age and gender are also considered. Younger drivers and males typically have higher premiums than older drivers and females, respectively, due to statistical accident rates.

Coverage Options, Cheapest auto insurance indiana

Choosing the right coverage options significantly impacts your premiums. Adding extras like roadside assistance or rental car coverage will affect the overall cost.

Tips for Finding the Cheapest Auto Insurance in Indiana

- Compare Quotes from Multiple Providers: Don’t settle for the first quote you receive. Use online comparison tools to get quotes from various insurance companies.

- Review Your Coverage Needs Regularly: Your needs may change over time, so periodically review your coverage and adjust it as needed.

- Consider Discounts: Look for discounts offered by insurance providers. These may include discounts for good students, safe drivers, or those who install safety devices.

- Bundle Your Insurance: Bundling your auto insurance with other insurance policies (e.g., homeowners) can sometimes lead to discounted rates.

- Shop During Off-Peak Periods: Insurance rates may fluctuate throughout the year. Consider shopping for coverage during less busy periods.

Frequently Asked Questions (FAQ)

- Q: How do I find reliable auto insurance quotes?

A: Use online comparison tools and contact several insurance companies directly.

- Q: What are the benefits of bundling my insurance?

A: Bundling often leads to discounts on multiple policies.

- Q: How can I lower my auto insurance premiums?

A: Maintain a clean driving record, consider discounts, and review your coverage needs.

- Q: What if I have a poor driving record?

A: You may find higher premiums but don’t despair. Shop around, and consider increasing your deductible. Contact your current provider to understand your options.

Resources: Cheapest Auto Insurance Indiana

Indiana Department of Insurance: [Insert Reliable Indiana Department of Insurance Link Here]

National Association of Insurance Commissioners: [Insert NAIC Link Here]

Disclaimer: This article provides general information and should not be considered financial or legal advice. Always consult with a qualified professional for personalized recommendations.

Ready to find the cheapest auto insurance in Indiana? Use our comparison tool today!

In conclusion, securing the cheapest auto insurance in Indiana requires careful comparison shopping, understanding coverage options, and potentially leveraging discounts. By taking these steps, drivers can potentially save substantial money while ensuring adequate protection on the road. Remember, while price is important, don’t compromise on necessary coverage.

Q&A

What are the most common discounts available for auto insurance in Indiana?

Many insurers offer discounts for safe driving records, anti-theft devices, good student status, and bundling insurance products (e.g., home and auto). Check with individual providers for specifics.

Source: cheapcarinsuranceco.com

How often should I review my auto insurance policy in Indiana?

Reviewing your policy at least annually, or whenever there are significant life changes (e.g., a new driver in the household, a change in your driving habits), is advisable. Insurance rates can fluctuate, and you may be able to find better deals.

Can I get cheaper auto insurance in Indiana if I live in a rural area?

Source: insuraviz.com

Rural areas often have lower insurance rates compared to densely populated urban areas in Indiana, due to lower accident rates. However, this is not always the case, and it’s crucial to compare quotes from different providers.